(Montréal) C'est le monde à l'envers: au Québec, l'immobilier sent la surchauffe, tandis qu'en Floride, la chute du prix des maisons donne froid dans le dos.

Le climat n'a jamais été aussi favorable pour les snowbirds qui rêvent d'acheter une maison en Floride. Le dollar est revenu à la parité. Les taux d'intérêt restent à un plancher historique. Et le prix des maisons en Floride a fondu de moitié depuis quatre ans.

La Floride a été l'un des États les plus malmenés par la crise de l'immobilier. Le prix d'une maison unifamiliale a fondu à 131 300$ US, en février dernier, selon la Florida Association of Realtors. Il s'agit d'une baisse de 46% par rapport au sommet de 244 200$ US établi en 2006 au faîte de la bulle.

«On le mesure très bien quand on fait évaluer des propriétés», confie Rosaline Cyr, présidente de NatBank, la filiale de la Banque Nationale en Floride, en entrevue téléphonique avec La Presse. «La semaine dernière, on a fait évaluer une très belle maison qui avait subi une dévaluation de 48%», dit-elle.

Dans certaines régions, la dégringolade a été encore plus douloureuse. Sur la côte Ouest, les prix se sont écrasés de près de 70% à Fort Myers-Cape Coral. Les maisons unifamiliales n'y valent plus que 88 000$ US.

Chute de plus de 50%

Et la situation est encore pire du côté des copropriétés. Pour l'ensemble de la Floride, le prix médian d'un condo a flanché de 58% depuis quatre ans, passant de 218 700$ US en février 2006 à 92 200$ US en février dernier.

Le prix est encore plus faible dans certaines régions comme Fort Lauderdale (71 500$ US), Fort Pierce-Port St. Lucie (74 000$ US) ou Orlando (50 100$ US).

«Je vois des beaux condos en bas de 100 000$ US. Deux chambres. Pas de rénovations à faire. À 125 000$, on peut décrocher quelque chose d'extraordinaire... peut-être pas sur l'eau, mais certainement sur un terrain de golf», confirme Mme Cyr.

Les acheteurs qui veulent s'établir directement au bord de la mer ou du canal intercostal, trouveront un condo très convenable entre 250 000$ US et 300 000$ US. En 2005, il fallait payer 600 000$ US!

Mais les acheteurs ne doivent pas se mettre la tête dans le sable. Ces prix de vente dégonflés cachent des «frais de condo» (charges de copropriété) très salés. «Il ne faut pas oublier que les associations de propriétaires ne sont pas en bonne santé financière», dit Mme Cyr.

Certains propriétaires ont été saisis. D'autres ont perdu leur emploi. Les propriétaires qui restent sont forcés de mettre les bouchées doubles pour renflouer les coffres de l'association.

Ainsi, il n'est pas inhabituel de payer 25 000$ US de frais par année pour un condo haut de gamme d'environ 600 000$ US... qui valait bien au-delà d'un million, il y a quatre ans.

Minuit moins une

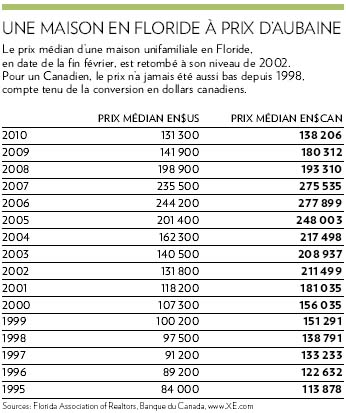

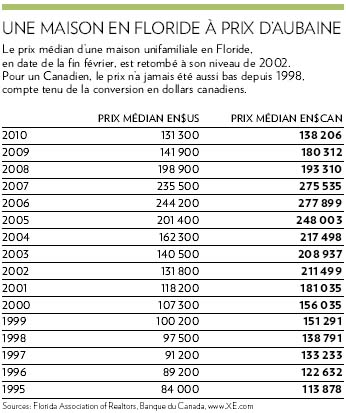

L'immobilier est retombé huit ans en arrière, en Floride. Pour trouver des prix aussi bas qu'aujourd'hui, il faut remonter jusqu'en 2002, alors que le prix médian d'une maison unifamiliale s'établissait à 131 800$ US.

Mais à l'époque, le dollar canadien était à un creux historique de 62 cents US. Pour un acheteur canadien, cela gonflait le prix d'une maison en Floride à 211 500$, comme le démontre notre tableau.

Pour un Canadien, le prix d'une maison en Floride est revenu au même point qu'il y a 13 ans, soit en 1997, en considérant le taux de change.

Mais à cette époque, leurs revenus étaient inférieurs et les taux d'intérêt étaient plus élevés. Si l'on tient compte de ces deux facteurs, les maisons en Floride n'ont probablement jamais été aussi abordables pour les acheteurs canadiens.

«Aux États-Unis, l'indice d'accessibilité est au septième ciel! Les maisons n'ont jamais été si peu chères», indique Yanick Desnoyers, économiste en chef adjoint à la Financière Banque Nationale.

À son avis, c'est le temps d'acheter en Floride. «Il n'y a pas vraiment de risque que le prix des maisons chute encore plus», assure-t-il. Les mises en chantier ont considérablement baissé, ce qui contribue à rétablir l'équilibre entre l'offre et la demande. De plus, le marché de l'emploi se redresse aux États-Unis, ce qui devrait limiter les reprises de finance (foreclosure).

«Le marché est au pire. Présentement, on fait du surplace. Tout indique que ça va être terminé en 2010, et que ça va repartir en 2011. Mais la reprise va être très longue», prévoit Mme Cyr.

Cependant, il ne faut pas attendre en 2011: «Si l'on veut profiter de la faiblesse des taux d'intérêt, il est minuit moins une», dit M. Desnoyers. À son avis, la Banque du Canada va relever bientôt son taux directeur. Les taux qui sont à un plancher de 0,25%, vont remonter graduellement à 2% d'ici 12 mois. Aux États-Unis, la Réserve fédérale haussera aussi les taux, mais avec un léger décalage.

Les prix selon la région de Floride

BRADENTON SARASOTA

Prix médian 2010 - 154 500$ US

Prix médian2006 - 342 300$ US

Variation sur quatre ans -55%

FORT MYERS CAPE CORAL

Prix médian 2010 - 88 000$ US

Prix médian2006 - 279 900$ US

Variation sur quatre ans -69%

ORLANDO

Prix médian 2010 - 130 800$ US

Prix médian2006 - 257 200$ US

Variation sur quatre ans -49%

FORT PIERCE PORT ST. LUCIE

Prix médian 2010 - 96 800$ US

Prix médian2006 - 248 400$ US

Variation sur quatre ans -61%

WEST PALM BEACH BOCA RATON

Prix médian 2010 - 219 100$ US

Prix médian2006 - 391 000$ US

Variation sur quatre ans -44%

FORT LAUDERDALE

Prix médian 2010 - 186 700$ US

Prix médian2006 - 360 800$ US

Variation sur quatre ans -48%

MIAMI

Prix médian 2010 - 191 100$ US

Prix médian2006 - 368 700$ US

Variation sur quatre ans -48%

Source: Florida Association of Realtors